Chartered Accountant As a Career Scope

Introduction about Chartered Accountant

INTRODUCTION

The Chartered Auntants are entrusted with substantial responsibility under various legislations such as compulsory audit of the all companies, banks, stock brokers, big income-tax assesses, large bank borrowers, etc. This shows the confidenceand trust reposed by the Government and society in the profession.Chartered Accountancy is a profession which comes in the top options in India because of the huge growing demand and practical exposure it needs. The areas which are dealt in this profession are taxation, corporate finance, project evaluation, business & corporate low, auditing, accounting practice.

“Chartered Accountancy [CA]" course is the BEST professional course in India. In other courses, people ask "Are you Civil or Electronics or Mechanical or IT etc?" or "Delhi or Mumbai etc?" But no question is asked if you are a qualified CA, regardless of wherefrom you qualify CA course.

The amount of investment in this professional course is not at all costly when compared to other professional courses. The only investment aspect in this course is the time; it takes only 4 years + from start to finish all in the first attempt.

With the rapid growth in economy, careers in finance and accounts have gained tremendous popularity and the most prestigious career option in this field is that of Chartered Accountant. Chartered Accountancy is a dynamic, challenging and rewarding profession. All the countries have their own Accountancy Association which regulates the quality and quantity of the professionals in this field. Chartered Accountancy Course is a professional course in Accounting introduced in our country in 1949, with the enactment of the Chartered Accountants Act. The Institute of Chartered Accountants of India (ICAI) was formed the same year. This Institute is both an examining and a licensing body. It is the responsibility of the institute to conduct the Chartered accountancy (CA) Course. The course involves a blend of theoretical education and practical training which run concurrently for a period of three years and equips a student with knowledge, ability, skills and other qualities required of a professional accountant.

A Chartered accountant is one who is specialized in accounting, auditing and taxation. He also serves as a management and corporate caretaker. In recent times, accountancy has become popular as a profession. The services of a CA are required in money matters even in a small business. Moreover according to the Company Act only CA's in professional practice are allowed to be appointed as auditors of companies in India. A chartered accountant is a person who is accepted as a member of the Institute of Chartered Accountants of India (ICAI) after having passed the Final examination of the Chartered accountancy course conducted by the institute.

CA programme is of two years apart from the training period. It has three sections, Competency Professional Test (CPT) that was earlier known as Professional Education exam PE1, Professional Competency Examination (PCE) and Final examination. The registration for CPT and PCE is open throughout the year. A student may register at any time during the year. However, as the examinations will be held twice a year in May and November, it is necessary that a student must register at least ten months before the examinations. After passing the Professional Competency Examination (PCE) candidates are eligible for registration as articled clerks/audit clerks for practical training. Computer Training Programme, i.e. 100 hours Information Technology is compulsory for the candidates who wish to register themselves as auditor clerk. Students can undergo this programme while pursuing CPT or PCE.

Articled clerk is a trainee attached to a practicing chartered accountant under a Deed of Articles for the duration three years. During this period the articled clerk will also need to continue studies for the CA exam. An audit clerk is a person who has served as a salaried employee for a minimum period of one year under a practicing chartered accountant. During the training period, candidates would be required to work in different areas learning the basics of auditing and taxation. This training enables them to learn the technical details of the job as well as to get an idea of the working environment of the profession.The scope for this lucrative career is bright in an economically developing nation like ours and as such the career can be termed as challenging and rewarding for competent professionals in the field.

The types of functions generally performed by the Chartered Accountants are quite varied; some of the important ones amongst them are listed below:

(i) Accountancy: The writing up of accounts and the preparation of Financial statements from the simplest receipts and payment Accounts of a small club to the complex and detail accounts of large public limited companies.

(ii) Auditing: The purpose of auditing is to satisfy the users of financial Statements that the accounts presented to them are drawn up on Correct accounting principles and that they represent a true and fair view of the state of affairs.

(iii) Taxation: The assessment of taxes is closely linked to financial Accounts. The Chartered Accountant with his experience in accounts is in an advantageous position to prepare the returns for tax purposes, represent assesses before the income tax authorities and render general advice on taxes to his clients. The services of CA may be requisitioned by the tax department for auditing taxation cases with large revenue potential.

(iv)Cost Accountancy: A Chartered Accountant is equipped to provide information on costing for the guidance of management, introduce cost control methods and assist the management in determining appropriate selling prices.

(v) Special Company Work: The services or advice of Chartered Accountants are frequently sought in connection with matters such as the formation, financial structure and liquidation of limited companies.

(vi) Investigation: Chartered Accountants are often called upon to carry out investigation to ascertain the financial position of business house for the purpose of issue of new shares, purchase or sale or financing of business, finding out reasons for increase or decrease of profits, reconstruction and amalgamations.

(vii) Executors and Trustees: A Chartered Accountant is also often appointed executor under a will or trust in order to carry on the administration of the estate or settlement.

(viii) Directorship: Many members of the Institute who hold senior positions in industry and commerce are also directors of their companies.

(ix) Companies Secretarial Work: As a Secretary, the Chartered Accountant is an important link in the management chain.

(x) Management Accounting: The Chartered Accountant’s service is utilized in a variety of ways like formulation of policies, control and performance evaluation.

(xi) Share Valuation Work: A Chartered Accountant undertakes the valuation of shares of public and private companies at the time of amalgamation or reorganization.

(xii) Other Activities: Other duties undertaken by a Chartered Accountant includes those of an Arbitrator for settling disputes specially those connected with insolvency work such as the preparation of statements of affairs and the duties of a trustee in bankruptcy or under a deed of arrangement.

To be good Chartered Accountant, you require not just business acumen and numerical ability, but good communication skills, objectivity, independence of thought and integrity coupled with the ability to work under the pressure of deadlines.

Eligibility

A Candidate who has passed the 10th examination can register for the Competency Professional Test (CPT) of the CA programme. But they can write the examination only after passing the Senior Secondary Examination (10+2) or waiting for the 10+2 exam results. There are no restrictions with regard to the age of the candidate or marks secured in Senior Secondary Examination.

Commerce graduates with 50% marks, non-commerce graduates with subjects other than Mathematics with an aggregate of 55% marks and non-commerce graduates with Maths with an aggregate of 60% marks are exempted from the Competency Professional Test (CPT) and are permitted to register for Professional Competency Course (PCC).

After passing Professional Competency Course, the candidates can register as Articled clerks for practical training and for admission to the Final course of the Chartered Accountant. Every graduate above18 years of age is eligible to register as an articled clerk/Audit Clerks for Chartered Accountancy. Computer Training Programme is compulsory for the candidates who wish to register themselves as auditor clerk. They should undergo 100 hours training in Information Technologyalong with PCE.Candidates aspiring for this career should have a pleasing personality, practical approach and a natural instinct to deal with figures to do well in this profession.

Requirements Steps to become a CA :

- Once you pass out your Class 10th examinations from a school which is recognized by the central government you need to Enrol with the Institute for Common Proficiency Test.

- After completing the Class 12 ie Senior Secondary Examinations the student should appear for Common Proficiency Test which is held twice a year ie june & december though the exam dates keep changing.

- Join PCC, articled training with a certified Chartered Accountant and register for a 100 Hours Information Technology Training[ITT] with listed institutes like NIIT, Aptech etc after passing CPT & 10+2 Exams.

- The Student should complete the 100 Hours ITT Course within 3 months of time which is generally a 25days program based on 4 hours/day schedule with the computer institute and its useful for learning computer based auditing and related computer course.

- Next the CA Student has to appear for PCE Exam[Professional Competence Examination] if he has worked as an article clerk with a CA for a period of 15 months minimum 3months prior to the exam month and also has to have completed the 100 Hours computer training course. Note that 8 months of audit training is equally treated as 6 months of articled training as per the requirement.

- Next the student has to join the CA Final course after passing the above mentioned PCE and while registering collect study materials and start the preparation for final CA Exams. He should also complete General Management and Communication Skills Course during the last 12 months of articled trianing and should also have completed 3.5 years articled training.

- Appear for the final CA Exam when the practical training is completed. Pass the final exam and complete the General Management and Communication Skills Course[GMCS]

After the completion of all the above mentioned steps , the student would be called Associate Chartered Accountant[ACA] because he is in the starting stage and after professional experience he would become Fellows Chartered Accountant[FCA] after which he is eligible to hold a certificate for public practice.

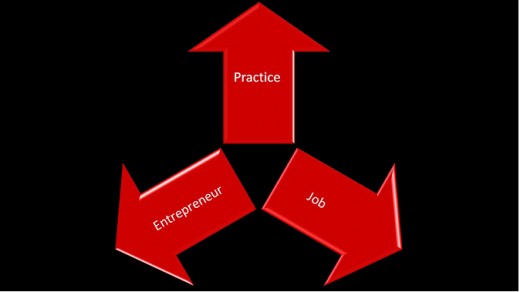

Career Option for a CA

There are a lot of career choices after a student becomes a CA. Some of them are listed below:

What a CA can do in JOB??

- Chief Accountant

- CFO(Chief Financial Officer)

- Chief Manager- Internal Audits

- Head –Training

- Lecturer/Professor

- Chief Manager-Management Audits

- Chief Manager- System

- Advisor to Government

What a CA can do during PRACTICE??

- Auditing & Assurance

- Tax Consultancy

- Financial Consultancy

- Project Planning and Consultancy

- Accounting Services

- Business Valuation

- Financial Reporting

- Cost Accounting

- Cost & Management Consultancy

- Accountants & Finance Outsourcing

- Investment Planning

- Portfolio Management

- Business Valuation

CA as an ENTREPRENEUR

1. Enterprise

- BPO/KPO/AFO

- Business

- Training Institute

2. Directorship

- Managing Director

- Finance Director

- Executive Director

3. Others Roles

- Arbitrator

- Trustee

- Executor

Job Prospects and Work Area

The growing importance of trade and industry along with the rapid growth of capital and money markets in an economically developing nation like ours has increased the importance of Chartered Accountants enormously. Moreover all the companies registered under the Companies Act, are required to get their accounts audited only by practicing Chartered Accountants. A qualified Chartered Accountant has the option of joining the Government Service, Public Sector undertakings or taking up a lucrative assignment in the private sector. The duty of Chartered accountant is to ensure that the financial transactions of an organization are maintained according to the law; they also keep track of cost of management of the company and manage tax matters.

Chartered accountants work as Finance Managers, Financial

Controllers, Financial Advisors or Directors (Finance)

and watch over the finances in the day to day management of companies.

Their main areas of work include Accountancy, Auditing, Cost accountancy,

Taxation, Investigation and Consultancy.

The accounting department prepares, analyses financial reports and documents of an organization. Auditing involves checking the accuracy of the financial statements, ensuring that the accounts presented are drawn up on correct accounting principles. Cost Accountancy involves maintaining cost auditing records, compiling cost information, installing cost control and performing cost audits. Taxation involves dealing with direct taxes, like income tax and wealth tax, assessment of taxes, filing returns and providing advice on indirect taxes. Investigation includes expert examination of specific aspects of businesses for the information of interested parties on new issues of share capital, the purchase, sale or financing of a business and for reconstruction. The various areas of consulting include Management accounting and internal audit, corporate law advice, project planning and finance, business advise, systems design and information consultancy. Chartered Accountants also act as directors, arbitrators for settling disputes, handling work related to insolvency, bankruptcy etc. and also as executors under a will or trust in order to carry out the administration of an estate or settlements. They are also engaged in activities like markets research, budget planning, working capital management, inventory control, policy planning, securities consultancy, registrar of issues of securities etc.

Some of the opportunities available for Chartered Accountants are in capital markets, business houses and industry. They can also have their own consultancy or private practice which could be more lucrative and satisfying.

They are also well placed in government sector as director finance, chief executive or the Head of the Department of the accounts, information technology etc. They help the government for proper implementation of accounting system.

Other career option: After passing the CA examination one could go for management Accountancy course; courses like Diploma in Insurance and Diploma in Information System Auditing.

Prospects Abroad: Institute of CA of India is well recognized by Institute of England, Wales and Australia. The members of ICAI can do practice or they can go for employment in these countries. ICAI is not approved by several countries like United Nations of America. Since ICAI is a member of the international Federation of Accountants committee and also international federation of Accounting Standard board, one can do their services in these countries. But for practicing they should undergo a particular examination conducting by the respective countries. The examination conducted by UNA is called CPA, Certified Public Accountant Examination.